Contribution Margin Ratio Formula Per Unit Example Calculation

The contribution margin is used by internal management to gauge the variable costs of producing each product. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point. In other words, it measures how much money each additional sale « contributes » to the company’s total profits. Fixed costs are costs that are incurred independent of how much is sold or produced.

To Ensure One Vote Per Person, Please Include the Following Info

Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. Fixed and variable costs are expenses your company accrues from operating the business. This means that, for every dollar of sales, after the costs that were directly related to the sales were subtracted, 34 cents remained to contribute toward paying for the indirect (fixed) costs and later for profit.

Is Contribution Margin Higher Than Gross Margin?

Still, of course, this is just one of the critical financial metrics you need to master as a business owner. They can use that information to determine whether the company prices its products accurately or is likely to turn a profit without looking at that company’s balance sheet or other financial information. You can use contribution margin to help you make intelligent business decisions, especially concerning the kinds of products you make and how you price those products. Imagine that you have a machine that creates new cups, and it costs $20,000. To make a new cup, you have to spend $2 for the raw materials, like ceramics, and electricity to power the machine and labor to make each product.

Contribution margin as a measure of efficiency in the operating room

If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit. The difference between fixed and variable costs has to do with their correlation to the production levels of a company.

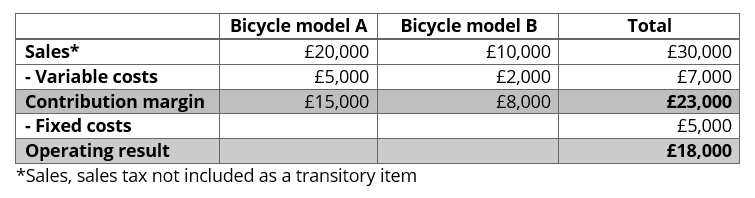

The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. More specifically, using contribution margin, your business can make new product decisions, properly price products, and discontinue selling unprofitable products that don’t at least cover variable costs. The business can also use its contribution margin analysis to set sales commissions. Gross margin is calculated before you deduct operating expenses shown in the income statement to reach operating income. Each profit measure can be expressed as total dollars or as a ratio that is a percentage of the total amount of revenue.

Free Financial Modeling Lessons

To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. The larger the contribution margin, the better, as it indicates more money to apply to fixed costs. What’s leftover after variable and fixed costs are covered is the profit. If the margin is negative, the company is losing money producing the product. Yes, the contribution margin will be equal to or higher than the gross margin because the gross margin includes fixed overhead costs. The contribution margin excludes fixed costs, so the expenses to calculate the contribution margin will likely always be less than the gross margin.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis.

- It is calculated by dividing the contribution margin per unit by the selling price per unit.

- This is because fee-for-service hospitals have a positive contribution margin for almost all elective cases mostly due to a large percentage of OR costs being fixed.

- Yes, the contribution margin will be equal to or higher than the gross margin because the gross margin includes fixed overhead costs.

It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time. Contribution format income statements can be drawn up with data from more than one year’s income statements, when a person is interested in tracking contribution margins over time. Perhaps even more usefully, they can be drawn up for each product line or service.

It is calculated by dividing the contribution margin per unit by the selling price per unit. Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05. The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits. The contribution margin measures how much money each additional sale contributes to a company’s profits. Business owners generally use the contribution margin ratio on a per-product basis to determine the portion of sales generated that can contribute to fixed costs.

Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs. The contribution margin (CM) is the amount of revenue in excess of variable costs. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs. Whether you sell millions of your products or 10s of your products, these expenses remain the same.

Variable costs, such as implants, vary directly with the volume of cases performed. Where C is the contribution margin, R is the total revenue, how to calculate depreciation rate % from depreciation amount and V represents variable costs. It is the monetary value that each hour worked on a machine contributes to paying fixed costs.

Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. The contribution margin income statement separates the fixed and variables costs on the face of the income statement. This highlights the margin and helps illustrate where a company’s expenses.